The Estate Planning Attorney PDFs

Table of ContentsThe smart Trick of Estate Planning Attorney That Nobody is DiscussingHow Estate Planning Attorney can Save You Time, Stress, and Money.The Greatest Guide To Estate Planning AttorneyThe Best Strategy To Use For Estate Planning Attorney

Estate planning is an action strategy you can make use of to determine what happens to your possessions and responsibilities while you're alive and after you pass away. A will, on the other hand, is a legal paper that outlines just how possessions are dispersed, who deals with youngsters and pets, and any various other dreams after you pass away.

Claims that are turned down by the administrator can be taken to court where a probate court will have the final say as to whether or not the insurance claim is legitimate.

Estate Planning Attorney - An Overview

After the inventory of the estate has been taken, the value of assets computed, and tax obligations and financial debt paid off, the executor will after that seek permission from the court to distribute whatever is left of the estate to the recipients. Any kind of inheritance tax that are pending will come due within nine months of the date of fatality.

Each private locations their possessions in the depend on and names somebody other than their spouse as the beneficiary., to sustain grandchildrens' education and learning.

7 Simple Techniques For Estate Planning Attorney

Estate planners can function with the contributor in order to reduce taxed earnings as a result of those payments or develop strategies that maximize the result of those donations. my explanation This is an additional method that can be utilized to restrict death tax obligations. It includes an individual securing the current worth, and thus tax obligation liability, of their property, while connecting the value of future development of that capital to one more individual. This technique includes freezing the value of a property at its value on the day of transfer. Accordingly, the quantity of potential funding gain at fatality is likewise iced up, allowing the estate coordinator to approximate their potential tax obligation responsibility upon death and far better prepare for the repayment of revenue taxes.

If sufficient insurance coverage profits are available and the plans are effectively structured, any type of revenue tax obligation on the deemed personalities of properties following the death of a person can be paid without considering the sale of assets. Earnings from life insurance policy that are obtained by the beneficiaries upon the death of the guaranteed are usually revenue tax-free.

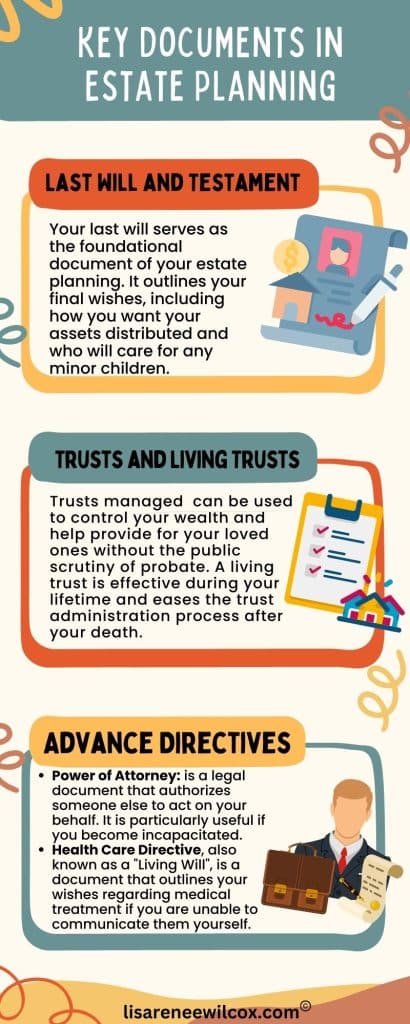

There are certain documents you'll need as part of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that this hyperlink estate planning is just for high-net-worth people. Estate preparing makes it simpler for people to determine their wishes prior to and after they pass away.

Not known Incorrect Statements About Estate Planning Attorney

You must start preparing for your estate as soon as you have any kind of measurable property base. It's an ongoing procedure: as life progresses, your estate strategy ought to change to match your situations, in accordance with your new objectives. And maintain it. Refraining your estate look at this now planning can trigger undue monetary burdens to liked ones.

Estate preparation is often taken a device for the wealthy. However that isn't the instance. It can be a helpful method for you to manage your assets and obligations prior to and after you die. Estate planning is likewise a wonderful way for you to lay out plans for the treatment of your small youngsters and pets and to describe your long for your funeral service and favored charities.

Eligible candidates that pass the exam will certainly be formally certified in August. If you're eligible to rest for the test from a previous application, you may file the brief application.